Get access to an exclusive list of pre-qualified investors and participate in the next

private share allocation in the world's leading AI technology company.

Have you noticed a trend in the last 10 years?

The big returns (1,000%+) are made when a company has its IPO.

Early-stage VCs are buying companies and taking them public at sky-high valuations 12 months later, for you and me to buy at a massive premium (and make the VCs and founders rich in the process).

We're tired of it– I bet you are, too.

Traditionally, it was impossible to buy pre-IPO stocks as a retail investor. That has changed in recent years. We will show you how!

Pre-Ipo Capital is an introducing agent that connects accredited investors who want to invest in private companies with closed-end investment funds who want to cash in on their various nonlisted stock strategies. We facilitate access to OpenAI stocks. There are two ways to get OpenAI shares. We can facilitate access to a round of funding and only selected investors can access them or we can buy stock options from the company's employees and directly own a stake in the company.

We serve high-net-worth individuals and wealthy families to access the markets that are reserved mostly for the largest financial firms and venture funds.

We offer access to the most exclusive investing opportunities in the world.

Be the first to know about the latest available shares or funding rounds with our notification service.

Apply to invest in OpenAI with usOpenAI began with an initial seed funding of $50 million from Elon Musk, who was a co-founder of the company before leaving in 2018.

The lab has raised a total of about $11.3 billion from 15 investors over seven funding rounds, with the vast majority of that funding — $11 billion — coming from Microsoft.

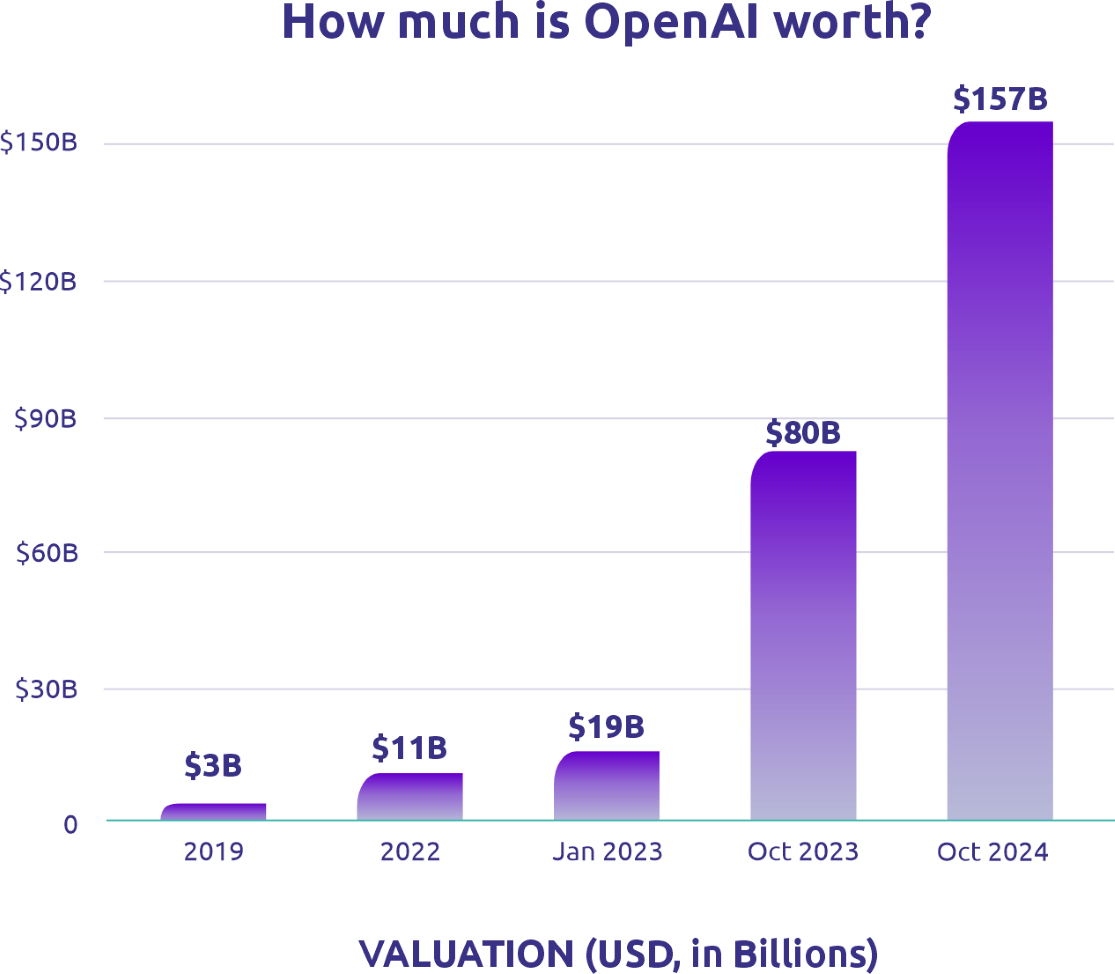

In April 2023, OpenAI raised $300 million from Thrive Capital, SVA, Andreessen Horowitz, Founders Fund, Alphabet, Wisdom Ventures, K2 Global, Sequoia Capital, and Tiger Global Management. The round valued the company at around $28.7 billion.

In October 2023, Thrive Capital announced it was leading another deal to purchase OpenAI shares from employees via a tender offer, valuing the company at $86 billion, or almost 3x more than the transaction that took place six months earlier.

In October 2024 the company reached a valuation of $157 billion. OpenAI is forecasted to grow to 500bn until 2032, and that these are conservative estimates.

Secure your financial future now

Consultancy PwC estimated that AI-related economic impact could reach $15.7 trillion globally by 2030, nearly the gross domestic output of China. The global AI market is expected to grow at a 31% compound average annual rate – much faster than Microsoft’s 18%.

OpenAI is by far the number one company in the field.

You can’t afford to miss this opportunity.

To take advantage of this limited-time offer, act fast as it is exclusively available to a limited number of sign-ups who provide a valid telephone number in the registration form, to confirm their willingness to receive a call from one of our financial representatives who will verify your eligibility for the offer. Don't miss out on this opportunity and sign up now!

In 2024, you can invest in stocks before IPOs and get in on the ground floor of the highest potential private companies, right alongside venture capitalists and private equity funds.